Dallas In the grocery and retail business there is a constantly shifting question about what is enough and what is too much when it comes to Wal-Mart. While I was in Dallas for some meetings, I read the end of a front page two-part series in the Dallas Morning News (part 2, part 1) about the expansion of Wal-Mart, which brought home the lessons we had recently learned in the Site Fighters Conference in St. Petersburg two months ago (www.sitefighters.org).

- Some points jumped out:

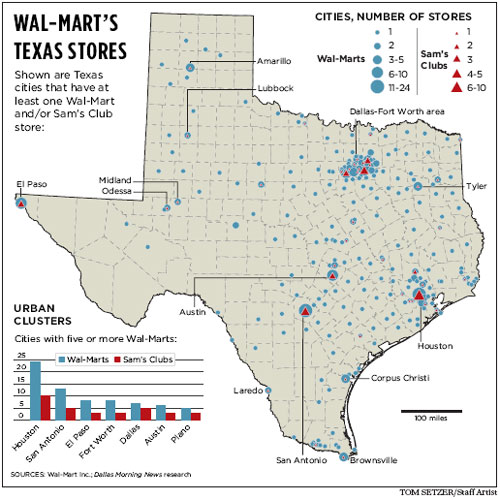

- There are 102 Wal-Mart stores in the Dallas-Fort market.

- One of every three dollars spent for food in D/FW is spent at Wal-Mart.

- Several years ago the Federal Trade Commission blocked the consolidation of two stores because it would restrain trade in D/FW, but that was before Wal-Mart’s expansion and rise to #1 in the market.

The most interesting though to me was the fact that Wal-Mart stores seemed roughly 8 minutes apart. This was exactly the driving time distance that WARN’s (www.warnwalmart.org) research team had determined was the company’s expansion plan in the Orlando and St. Petersburg markets! A highlight of the conference had been the presentations made by Greg Mellowe from WARN with help from of our friends from Gainesville that argued that one could predict the expansion and consolidation pattern of Wal-Mart with various technical and software tools. Now here in an even larger and more mature market not previously studied, one could see the pattern unfold even more aggressively. It appeared that we were right on the money!

Wal-Mart was equally clear that they thought there was a lot of room to grow in the D/FW market, even further indicating that the growth plan was straightforwardly to continue to expand until the pattern of its store placement achieved exactly the kind of distribution that we predicted. D/FW, like central Florida, seems to be ground zero for Wal-Mart’s growth and domination of the market.

The “site fight in a box” being developed by the WARN team in Florida looks like a full toolbox that will be urgently needed around the country in trying to understand and contend with Wal-Mart. Certainly if there is one thing we have learned in dealing with major corporations — if you can not understand and interact with their expansion program, you will never be able to get their attention and bring them to accountability.

- This all bears close watching.

November 3, 2005