Detroit The widening gap between black and white homeownership didn’t happen by accident. There is abundant evidence and little debate that the gap was the result of historic discrimination enforced by federal policies, state laws, and local ordinances. Even as ownership rates increased for minority homeowners over a 40-year period thanks to persistent work, legal action, and regulation of bank lending discrimination, the banking and real estate industry speculative bubble wiped out almost all of these gains through foreclosures and the credit desert that emerged after 2008.

Detroit The widening gap between black and white homeownership didn’t happen by accident. There is abundant evidence and little debate that the gap was the result of historic discrimination enforced by federal policies, state laws, and local ordinances. Even as ownership rates increased for minority homeowners over a 40-year period thanks to persistent work, legal action, and regulation of bank lending discrimination, the banking and real estate industry speculative bubble wiped out almost all of these gains through foreclosures and the credit desert that emerged after 2008.

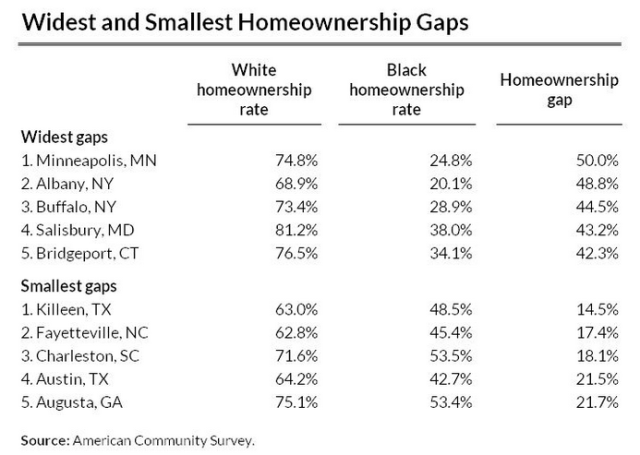

Meanwhile the gaps in black and white homeownership are huge and little to nothing is being done to make up the distance. A recently released report by the Urban Institute, hardly a liberal bastion as the think tank of developers and real estate interests, looked at the racial divide in the 100 largest cities in the United States. Few cities could claim any bragging rights other than being the best of a bad bunch. The reports authors were clear that the South and West were better than the North and Midwest, but mostly this was a race to the bottom.

The smallest gaps were Killeen, Texas at 14.5%, Fayetteville, North Carolina at 17.4%, Charleston, South Carolina at 18.1%, Austin, Texas, the largest city in the best five at 21.5%, and Augusta, Georgia at 21.7%. The hall of shame was led by Minneapolis with an outrageous 50% gap, Albany, New York another state capital had a 48.8% gap followed closely by Buffalo, New York with a 44.5% gap, Salisbury, Maryland on the eastern shore with a 43.2% gap, and Bridgeport, Connecticut, where ACORN once ran one of our most productive housing counseling programs with a 42.3% gap now.

Looking at large metropolitan areas with the largest number of black families doesn’t make the picture any prettier: New York City 34.6%, Chicago 35%, Atlanta 29.6%, Philadelphia 26.3%, and Washington, DC, 23%. Looking at cities where the ACORN Home Savers Campaign has been organizing is sobering as well: Pittsburgh 41.6%, Youngstown 41.8%, Cleveland 38.3%, Detroit 37.9%, Little Rock 33.5%, and Memphis 31.8%, along with Atlanta just below 30%. Where we have union offices Dallas is at 31.9%, Houston 29.9%, New Orleans 27.2%, Baton Rouge 30.1%, and Shreveport 31.2%. It feels no better to know that Milwaukee is at 40.7%, St. Louis 35.1%, Charlotte at 32.9%, Boston 32.4%, Phoenix 40.6% and Tampa-St. Pete at 32.5%. The report says western cities are better, but Los Angeles is the best with a 23.4% gap, San Francisco 29.8%, San Diego 28.9%, Las Vegas 30.8%, Denver 31.5%, Sacramento 33.9%, Portland 34.4% and Seattle 37.2%. You won’t drive into any city and find a sign celebrating this gap. Whether blue or red, the gaps are significant everywhere, and they are barriers to equality and obstacles to a flourishing democracy.

Did the 2008 financial crisis make a difference. Heck, yes. The Urban League report says the following, noting that Atlanta

“…has seen declining homeownership among black households, with a 6 percent drop since 2005 and a rate that now stands at 44.8 percent, down nearly 10 percent from the 2007 peak. Atlanta previously saw significant gains in black homeownership, reaching almost 55 percent in 2008. But the region was hit hard during the 2008 housing crisis, and market dynamics have made it difficult for black households to regain a foothold as owners.”

The New York Times in an editorial mentions that all of this has also opened up the door for predatory land contracts to surge which is what the ACORN Home Savers Campaign is all about, but noticing the obvious is not a program. Sadly, the current administration and little of anyone else in government, real estate, or banking has much to offer as a solution to discrimination this profound and persistent.