New Orleans The Consumer Finance Protection Bureau, a beleaguered federal agency much needed by consumers and much despised by the entire phalanx of Republican governmental officeholders, has released new rules for the payday lending industry. It wasn’t the full list of Christmas presents that many of us had sent the CFPB Santa Claus, but there were some pretty decent presents under the tree.

New Orleans The Consumer Finance Protection Bureau, a beleaguered federal agency much needed by consumers and much despised by the entire phalanx of Republican governmental officeholders, has released new rules for the payday lending industry. It wasn’t the full list of Christmas presents that many of us had sent the CFPB Santa Claus, but there were some pretty decent presents under the tree.

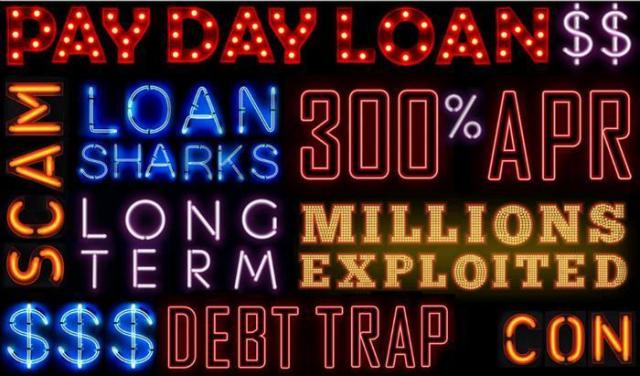

The key gift was a limit on loans to $500 and a cap of eighteen months between loans with a few exceptions that all could only be triggered based on an affordability or ability to pay standard. This is huge. As part of the national campaign ACORN Canada launched more than a decade ago in that country we arranged for an independent report by a recognized academic expert. The study found that the entire business model for payday lending companies – several of which were owned by companies in the United States – was premised on a constant churning of the loans that larded on interest and fees over a cycle of a year-and-a-half before a consumer could escape. This rollover is so baked into the current payday lending business model that the CFPB estimates that it will shrink the $6 billion industry by two-thirds.

The CFPB backed away from the issue of usurious interest rates on these loans, which has been ACORN’s key tool province by province in Canada in our fight with the industry. They also ended up walking away from similar predatory products like installment loans. On the other hand in conjunction with the Office of the Controller of the Currency they did slightly loosen restrictions on banks to allow more small scale personal loans for the lower income families demanding this kind of bridge financial assistance. Credit unions and community banks were largely exempted, and restrictions were lifted on smaller banks doing 2500 loans or less that are not more than 10% of their business. None of that is really enough, but it’s something.

One of ACORN’s most effective weapons in the fight against payday lenders sucking money from lower income families and neighborhoods has been our ability to win restrictive zoning codes, especially in the working class suburbs of Vancouver. The codes require distance from schools and some other facilities, like liquor stores, and from each other, which has limited new openings of such storefront outlets to a mere trickle.

Twenty states already have limits on payday lending in the US, but there is still a Scrooge hanging around these new rules that might protect our constituency in the other thirty states, and not surprisingly that’s in Congress. Elected representatives, long with their hands out for industry contributions and their arms locked with the industry lobbyists, have in some cases threatened to try to gut these new rules. The industry of course has threatened to sue to stop implementation now scheduled for 2019.

We’ve won a battle, not the war.