Detroit ACORN’s Convention is getting ready to roll into Detroit. Not surprisingly a huge focus of this meeting is going to be threat of foreclosure and the credit squeezes everyone for our members now. Since Detroit, the state of Michigan, and the general Midwest are ground zero for some of these problems, the ACORN Board’s decision to meet here seems propitious.

More than one mortgage company and many servicers have conceded across the table from ACORN negotiators that they simply will not write any new mortgages in places like Michigan. The job market is too unstable. Foreclosures are too common. They are redlining whole states rather than specific neighborhoods.

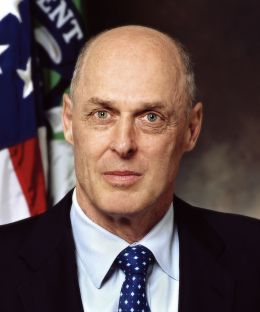

Treasury Secretary Henry Paulson the other day floated a trial balloon from the old countries of Europe. Something called “covered bonds,” which are a $2.75 trillion dollar market in Europe and the primary source of mortgage loan funding for Euro-banks. According to the story that ran in the Wall Street Journal, covered bonds are a kind of mortgage-backed security. Supposedly, the loans that are “covered” are composed of higher credit rated pieces, which raises money but results in lower interest payments for the investors, since theoretically there is less risk. The relative security makes them somewhat less speculative and would also in theory attract a different set of more diverse investors to help out on a bank’s funding sources.

Hmmmmmm. Maybe?

But, I can’t escape wondering and worrying about our members who will almost invariably not be in such a covered bond security pool of loans, because their credit scores, especially now, are going to be more challenged. A couple of years ago any of our members with a 500 or a 550 would have easily gotten a home loan. Now it might take a 650 credit score to get a loan and be in a covered bond kind of security.

Without a subprime market which has totally disappeared and without access to mortgage funds, many of our members and therefore lots of our neighborhoods are going to simply be locked out of the home buying market and the home ownership dream. The ACORN Convention theme this year is “Building Dreams across America.” This is one that is going to be a hammer-and-tong fight street by street just as it was 30 years ago.

We can’t go backwards though. Dreams are important!